The Board of Directors and the HRCG Committee regularly receive reports of shareholder engagements related to sustainability and give them careful consideration in developing the direction they provide to management. In that regard, the Board has received consistent feedback from shareholders over the last several fiscal years that environmental and social disclosures, particularly those that provide an analytical basis for measuring progress, are now an essential tool for investors. Many of the world’s largest investment banks and funds, including BlackRock, have made sustainability metrics a requirement for participation in their investment portfolios. With that in mind, and cognizant of the Company’s responsibility to be a good global citizen, the HRCG explored the adoption of one or more sustainability standards for future Linamar public disclosures. This process included learning more about the various sustainability standards that are gaining market acceptance, including the Task Force on Climate-related Financial Disclosures (“TCFD”), the Global Reporting Initiative (“GRI”) and Sustainability Accounting Standards Board (“SASB”) frameworks/standards.

The HRCG Committee recommended, and the Board accepted, that Linamar’s management should move towards the adoption of the SASB standards for annual public disclosures pertaining to environmental management. The HRCG Committee also noted that the SASB standards do not go far enough in disclosing certain social responsibility standards, such as the minimization of the usage of conflict minerals, and therefore requested that management make disclosures that, in certain instances, go further than what is required by SASB. The 2019 fiscal year is the first time that Linamar has reported to the SASB framework and does not currently track all metrics included in the Auto Parts Sector Standards but we look forward to including more data in the future. Please find the results of our initial disclosure below. We note that these results are limited in scope to just our Ontario based Canadian facilities. We aim to provide more complete measures in the coming years.

The below disclosures follow the framework for that are outlined by SASB for companies involved in the Transportation Sector – Auto Parts industry classification. Linamar’s recent decision to utilize SASB as a guideline for Sustainability disclosures will require significant resources, effort and investment in proper data systems and validation processes to fully disclose all metrics to the required guideline levels. As this is Linamar’s first time utilizing the framework, not all topic metrics are reported upon or discussed at this time. Look for more topic metrics and data disclosures to be added in future years.

Energy Management

Scope: Energy Consumed

Electricity Consumption is presented as Kilowatt Hours per Sales dollar (KWH / Sales $ CAD) as a method to measure efficiency as it relates to overall revenue generated by electricity unit consumed.

| 2019 | 2018 | 2017 | |

| KWH / Sales Dollar $ CAD | 0.0916 | 0.0933 | 0.0916 |

Above electricity metrics represents consumption originating from approximately 40% of Linamar’s global manufacturing facilities. Linamar’s intention is to develop and disclose overall targets for electrical reduction on a global basis. Accurate measurement and monitoring are the initial steps for full understanding in order to set improvement plans for overall reduction targets which will be disclosed in future reports.

Also noted, a significant portion of Linamar’s operations are located in the jurisdiction of the province Ontario, Canada. The above stated electricity purchased from utilities in this jurisdiction has a current installed supply capacity sources breakdown of Nuclear, 34%, Hydro 23%, Wind 12%, Solar 1%, with remaining coming from Gas/Oil or Biofuel.

Product Safety

Scope: Product recalls issued, both voluntary and involuntary.

Linamar’s products sold had zero product recalls from 2017 through 2019 inclusive, either voluntary or involuntary.

Design for Fuel Efficiency

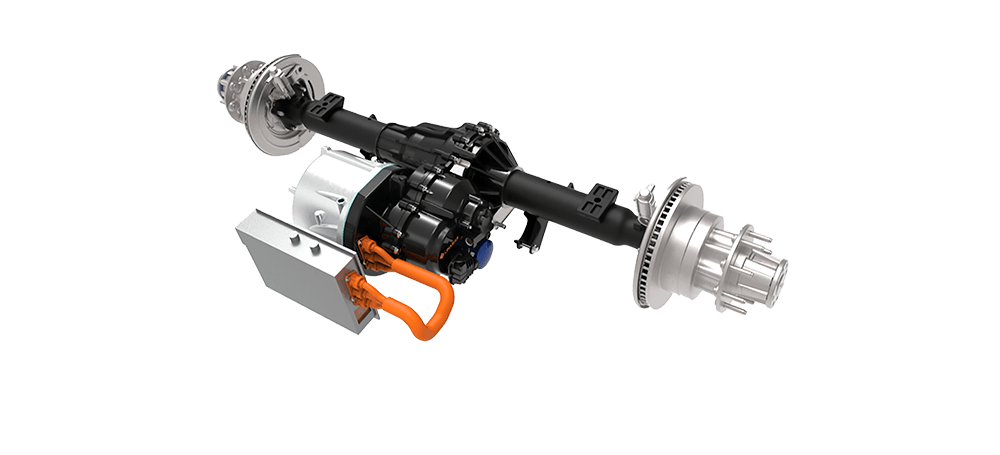

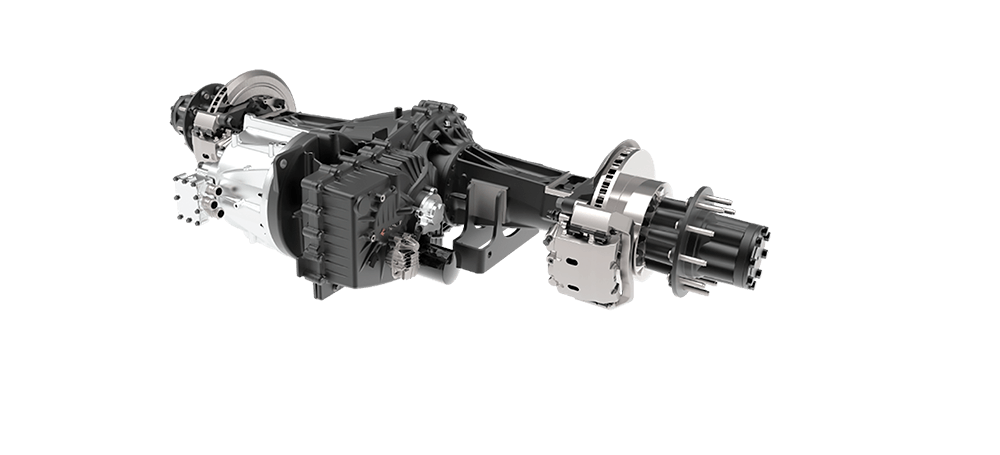

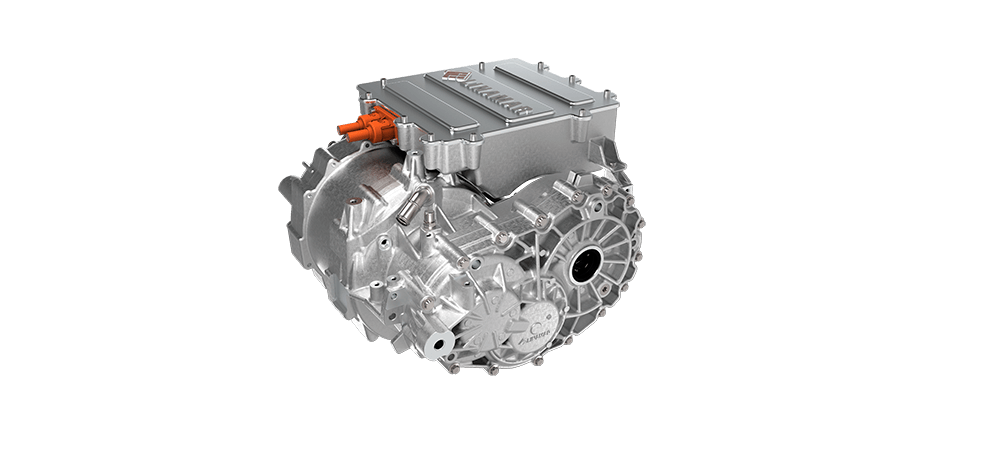

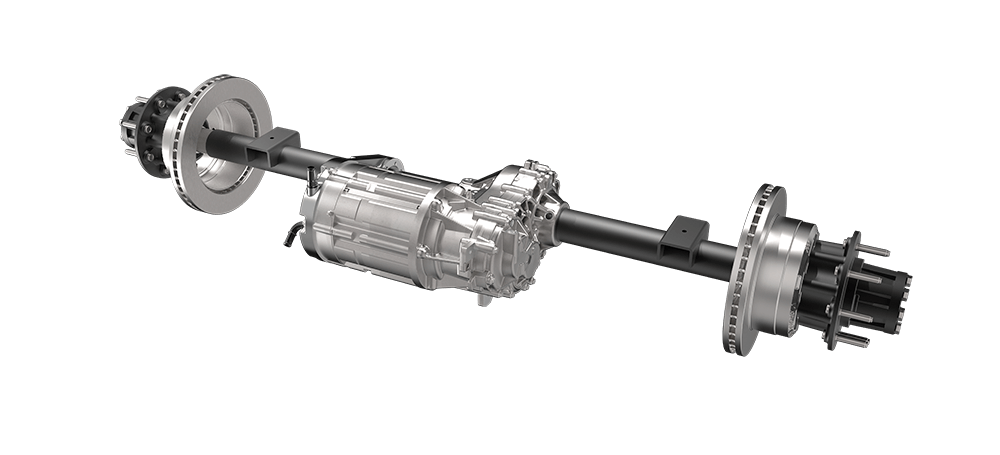

Scope: Products designed to increase fuel efficiency and/or reduce emissions.

Refer to main Sustainability section entitled “New Energy Vehicles and Improvements in Fuel Economy & Emissions” for full commentary on these products. Click here.

As stated previously, Linamar’s revenues on new transmission programs increased from 5% in 2014 to 30% in 2019, as a % of overall light vehicle classified revenues. Engine revenues on new engine programs increased from 14% in 2014 to 40% in 2019, as a % of overall light vehicle classified revenues. In addition, Linamar is significantly increasing its content on Electrified platforms over the coming years. Linamar’s portfolio now offers numerous lightweight aluminum and/or magnesium structural casting solutions that offer a significant weight savings over conventional stamped or fabricated BlackRock steel–making vehicles lighter and improving fuel efficiency.

Competitive Behaviour

Scope: Anti-competitive behavior matters resulting in associated monetary losses through legal proceedings

Linamar has not had involvement with any material anti-competitive, anti-trust issues throughout its global operations between the periods of 2017 through 2019 inclusive. Linamar operates in globally competitive product segments with a strong understanding of material and value-added cost inputs by both suppliers and customers, leaving little opportunity for substantial market pricing power within these segments.