May 8, 2024, Guelph, Ontario, Canada (TSX: LNR)

Strong financial performance

- Sales up 18.7% to $2.72 billion in Q1 2024;

- Normalized Operating Earnings1 up 38.7% in Q1 2024; and

- Normalized Diluted Earnings per Share1 up 30.8% in Q1 2024.

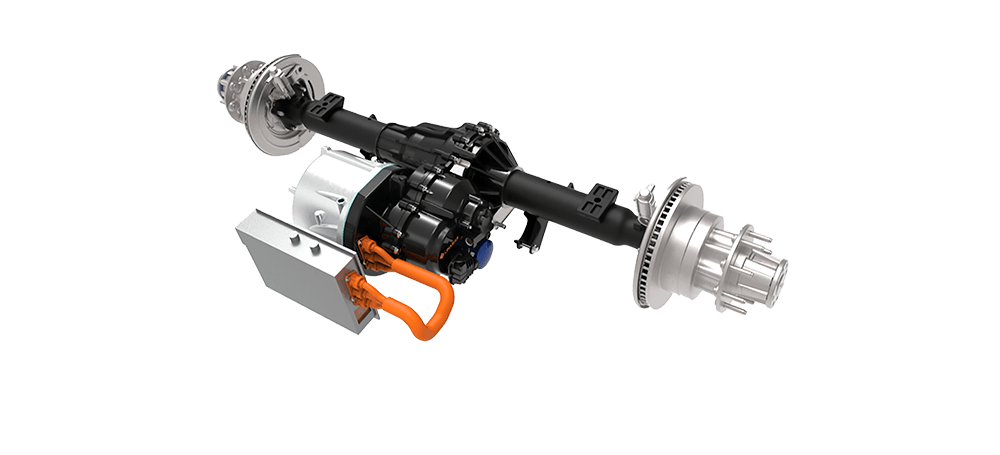

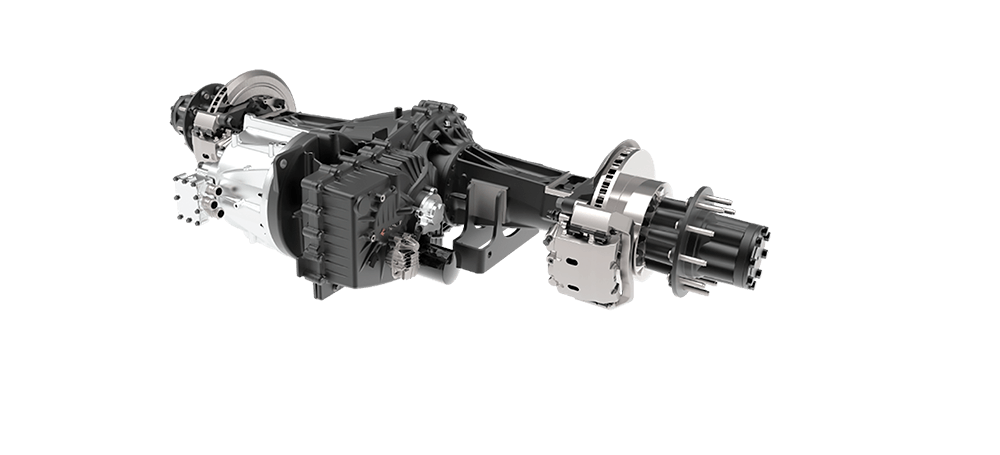

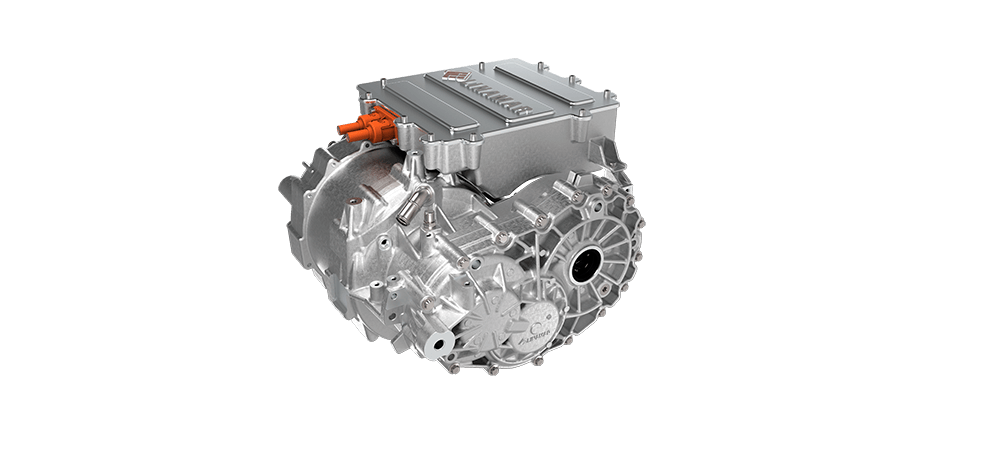

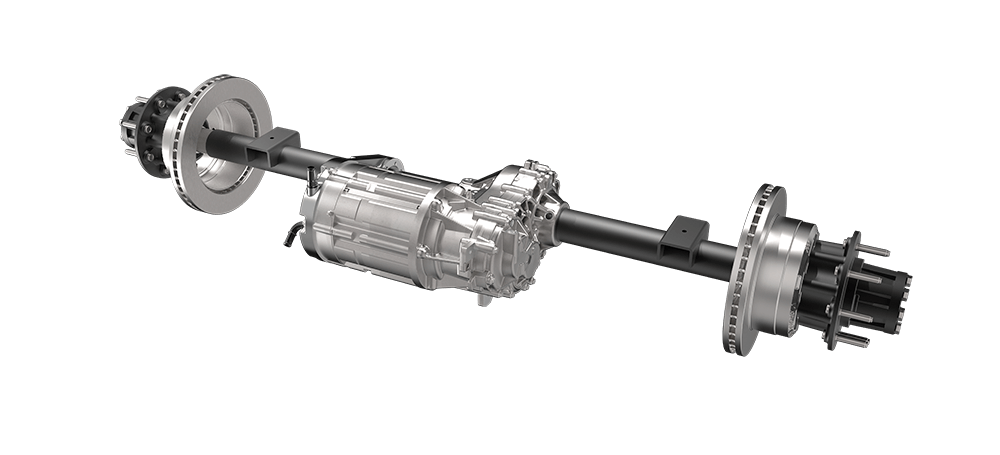

Mobility Segment

Mobility Segment Performing

- Mobility segment finished the quarter strong with normalized operating earnings up 57.9% compared to Q1 2023; and

- Second consecutive quarter of margin expansion with normalized operating earnings margin reaching 6.2%, meaningfully improved from 2023 levels.

Diversified Strategy Success

- Industrial normalized operating earnings up 23.3% over Q1 2023, anchoring solid overall performance further validating diversification strategy;

- Industrial normalized operating earnings representing over 49% of consolidated normalized operating earnings solidly anchoring Linamar as a Diversified Industrial Business; and

- The acquisition of Bourgault Industries Ltd. (“Bourgault”) completed, expanding our agricultural profile to include broad acre seeding.

Double-Digit Sales Growth in Both Segments on Strong Market Share Growth

- Sales up 24.5% for Industrial for the quarter, due to exceptional global market share growth for combine drapers combined with ourmost recent acquisition of Bourgault;

- Sales up 16.7% for Mobility in the quarter, driven by both our Linamar Structures 2023 acquisitions as well as launching programs and increased volumes; and

- Content per vehicle1 (“CPV”) up in every region, North American CPV hit a new quarterly record reflective of continued market share growth.

Returning Cash to Shareholders

- Linamar is maintaining its dividend to shareholders at quarterly $0.25 per share.